As the new year approaches, it's essential to stay informed about the latest updates on IRS contribution limits for Individual Retirement Accounts (IRAs), 401(k)s, and tax brackets. In 2025, the Internal Revenue Service (IRS) has announced changes to these limits, which can significantly impact your retirement savings and tax strategy. In this article, we'll break down the 2025 IRS contribution limits for IRAs, 401(k)s, and tax brackets, helping you make the most of your retirement planning.

2025 IRA Contribution Limits

The IRS has increased the annual contribution limit for IRAs to $6,500 in 2025, up from $6,000 in 2024. This limit applies to both traditional and Roth IRAs. Additionally, if you're 50 or older, you can take advantage of the catch-up contribution, which remains at $1,000. It's essential to note that these limits apply to your combined contributions to traditional and Roth IRAs.

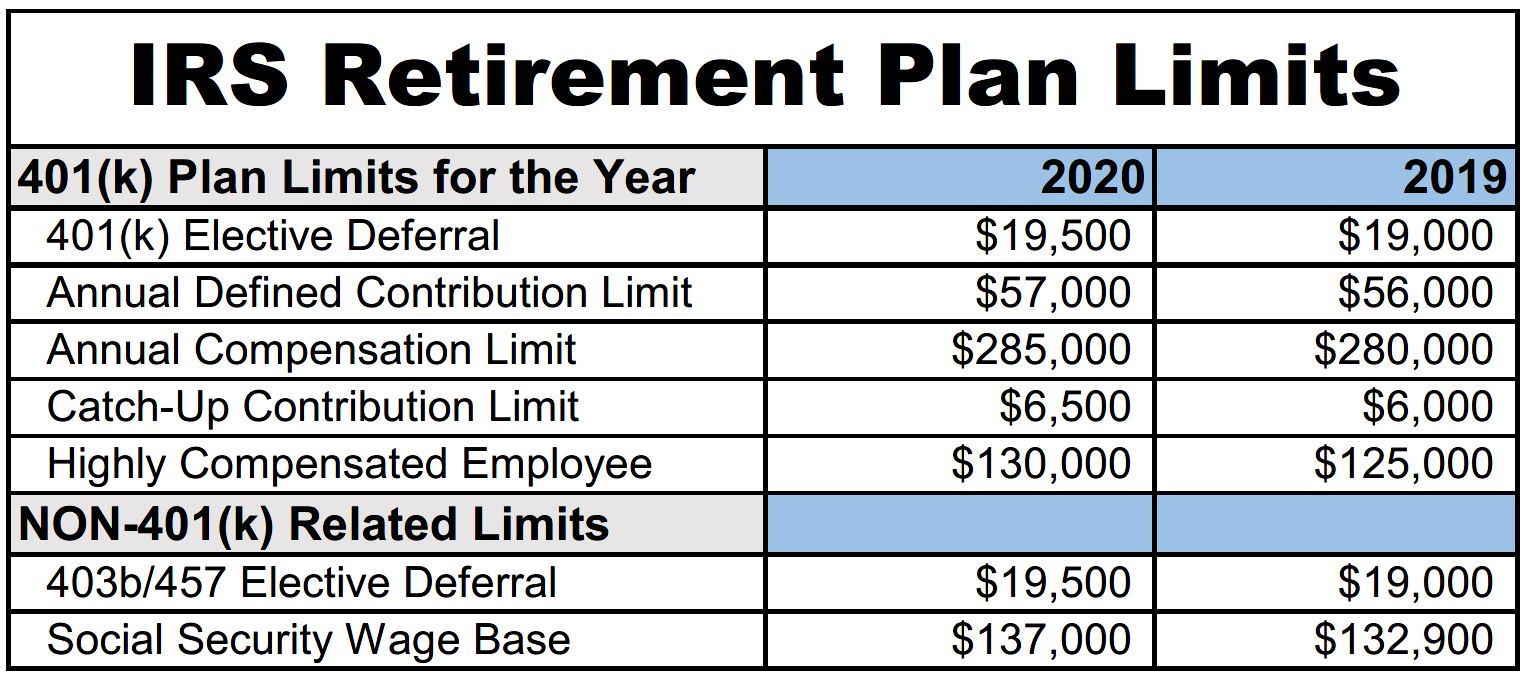

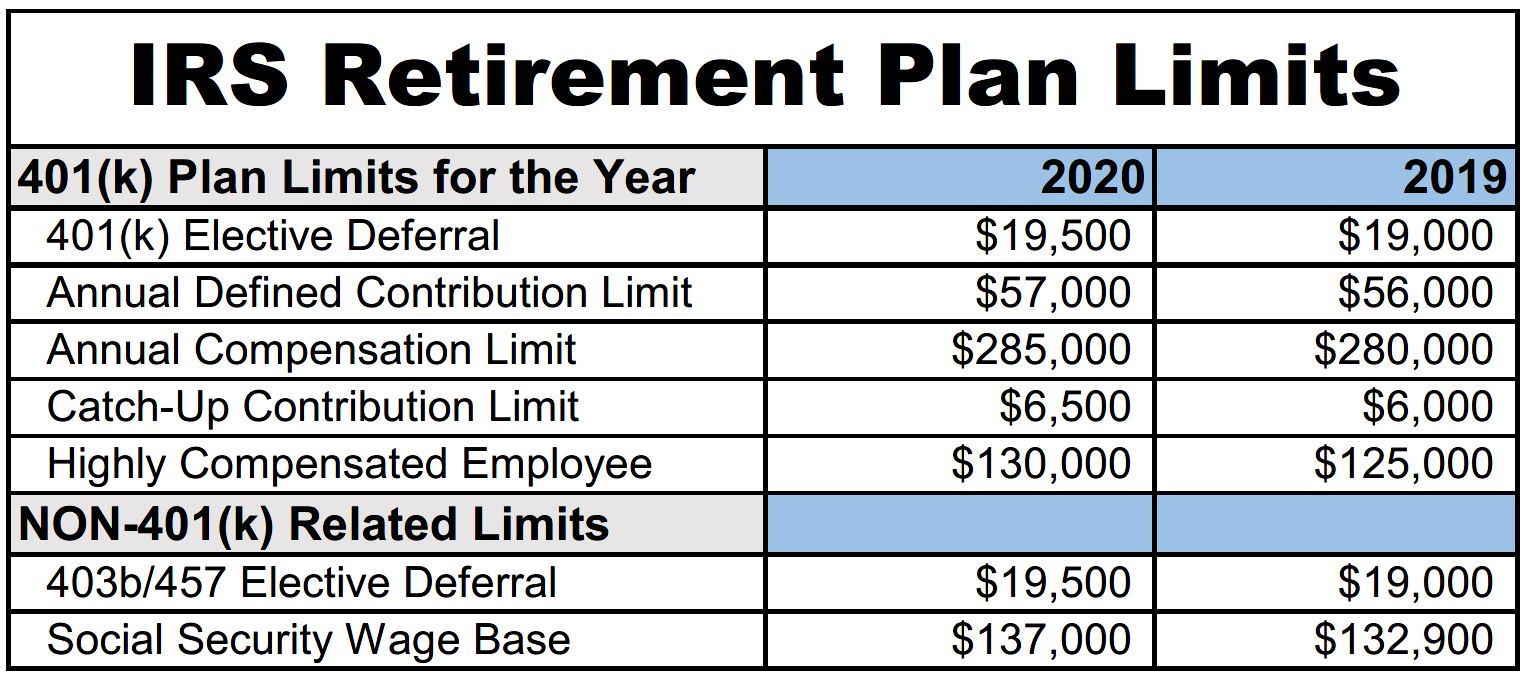

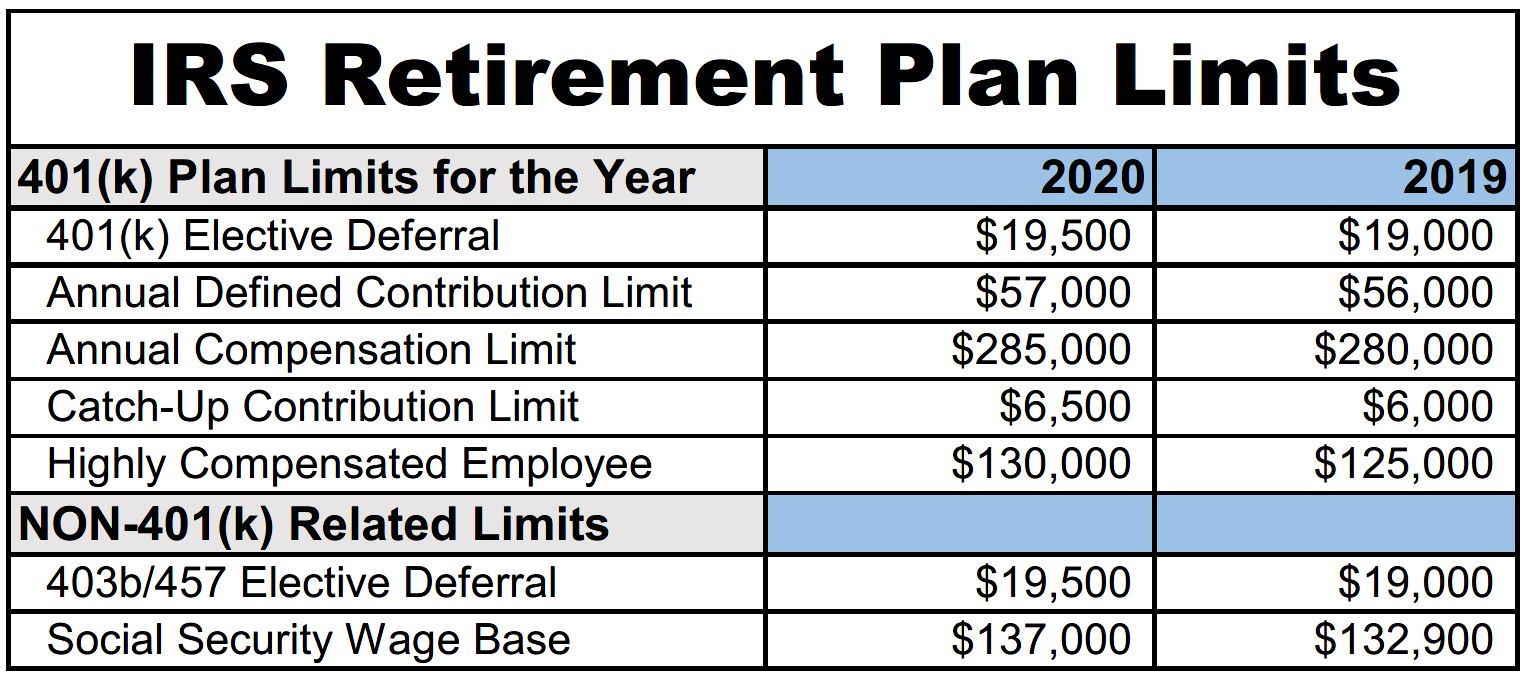

2025 401(k) Contribution Limits

For 401(k) plans, the annual contribution limit has increased to $22,500 in 2025, up from $22,000 in 2024. The catch-up contribution limit for those 50 or older remains at $7,500. These limits apply to 401(k), 403(b), and Thrift Savings Plan contributions. If you're eligible, consider maximizing your 401(k) contributions to take full advantage of employer matching and tax benefits.

2025 Tax Brackets

The IRS has also updated the tax brackets for 2025, which can impact your tax strategy. The new tax brackets are as follows:

10%: $0 to $11,600 (single) or $0 to $23,200 (joint)

12%: $11,601 to $47,150 (single) or $23,201 to $94,300 (joint)

22%: $47,151 to $100,525 (single) or $94,301 to $201,050 (joint)

24%: $100,526 to $191,950 (single) or $201,051 to $383,900 (joint)

32%: $191,951 to $243,725 (single) or $383,901 to $487,450 (joint)

35%: $243,726 to $609,350 (single) or $487,451 to $731,200 (joint)

37%: $609,351 or more (single) or $731,201 or more (joint)

Understanding these tax brackets can help you optimize your tax strategy and minimize your tax liability.

In conclusion, the 2025 IRS contribution limits for IRAs, 401(k)s, and tax brackets offer opportunities to maximize your retirement savings and optimize your tax strategy. By staying informed about these updates, you can make the most of your retirement planning and secure a brighter financial future. Remember to consult with a financial advisor or tax professional to ensure you're taking full advantage of these limits and making the best decisions for your individual circumstances.

Remember to always check the official IRS website for the most up-to-date information on contribution limits and tax brackets. By staying informed and planning ahead, you can achieve your long-term financial goals and enjoy a secure retirement.